Business Responsibility Sustainability Reporting (BRSR) services

Enhance your Business Responsibility and Sustainability Reporting with DNV

In today's rapidly evolving business landscape, stakeholders are increasingly prioritizing sustainability and corporate responsibility. At DNV, we offer compreensive services to help companies navigate and excel in their Business Responsibility and Sustainability Reporting (BRSR). Our expertise and global presence make us the ideal partner to support your sustainability journey, ensuring compliance, transparency, and positive impact.

About BRSR:

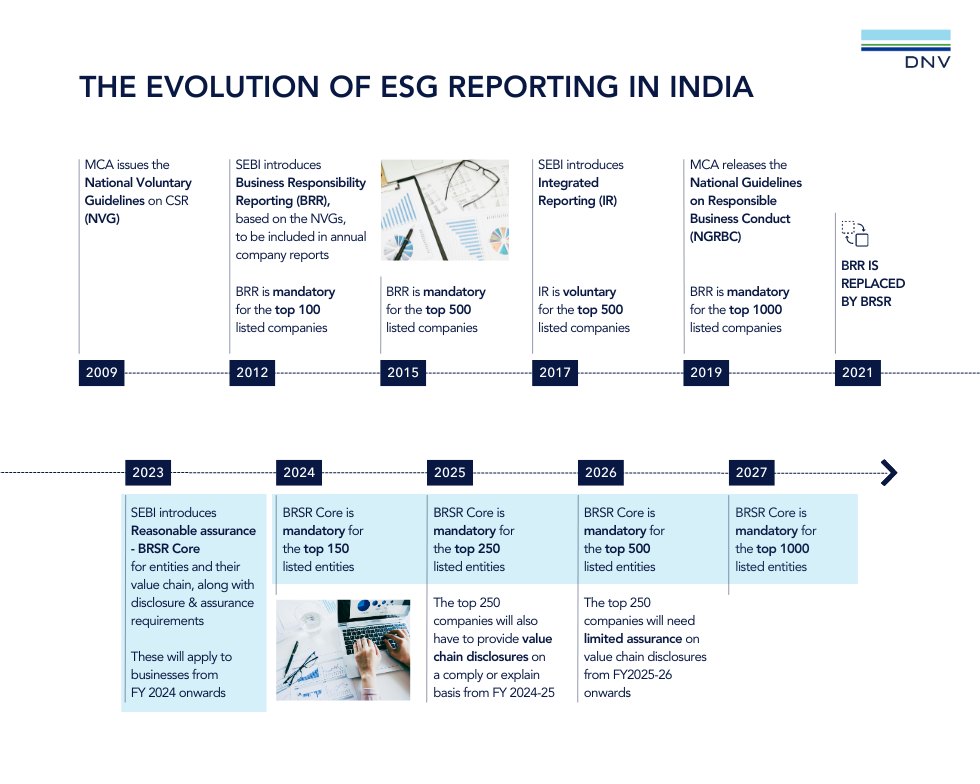

On 10th May 2021, SEBI introduced new sustainability reporting requirements for listed entities. The BRSR is a notable departure from the existing Business Responsibility Report (“BRR”) and a significant step towards bringing sustainability reporting at par with financial reporting.

BRSR is applicable to the top 1,000 listed entities, as determined by market capitalization. The reporting was voluntary for FY22 (the year ending in March 2022) and now mandatory from FY23 onwards.

The BRSR regulation paves the way for significantly improved ESG (Environmental, Social and Governance) disclosures in terms of both breadth and trends over past years. Emphasizing quantifiable metrics, BRSR enables easier comparability across sectors and time periods, significantly enhancing disclosures on climate/environment and social issues related to employees, consumers, and communities.

Why BRSR matters?

- Drive transparency and trust

The BRSR framework is designed to enhance corporate transparency and accountability, providing stakeholders with valuable insights into a company’s sustainability practices. Adhering to BRSR not only fulfils regulatory requirements but also builds trust with investors, customers, and the wider community. - Improve ESG performance

By effectively reporting on environmental, social, and governance (ESG) metrics, companies can identify areas for improvement, set meaningful targets, and track progress. This leads to better risk management, enhanced reputation, and long-term value creation.

Key components of BRSR:

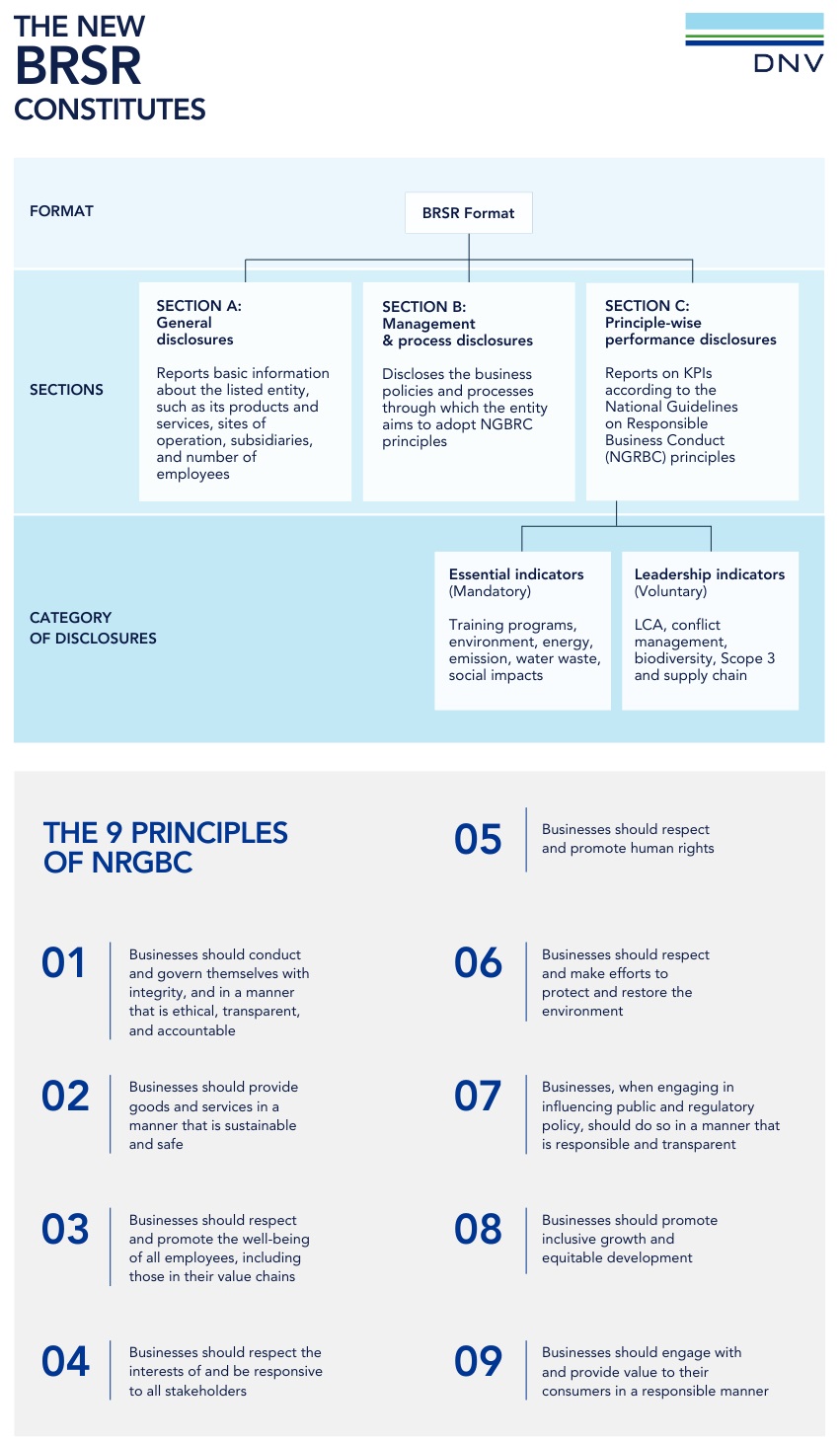

The BRSR is structured into three comprehensive sections:

Section A: General Disclosures

This section provides an overview of the company's fundamental details:

- Company details: Information about the listed entity, including products and services, operational locations, and the number of employees.

- Subsidiaries: Details about the company’s subsidiaries and their operations.

- Corporate Social Responsibility (CSR): Transparency in CSR initiatives, including the company’s approach and specific projects undertaken.

Section B: Management and Process Disclosures

This section focuses on the company's ESG policies and governance structures:

- ESG Policy: Overview of the company’s environmental, social, and governance policies.

- Governance and oversight: Details on the governance structures in place to oversee ESG initiatives.

- Leadership approaches: Insights into the leadership's role in driving sustainability, including their approaches and commitments.

Section C: Principle-wise Performance Disclosures

This section is divided into two parts—Essential Indicators and Leadership Indicators—based on the National Guidelines on Responsible Business Conduct (NGRBC) principles:

- Essential Indicators:

- Training programs: Information on training programs related to sustainability and responsible business conduct.

- Environmental metrics: Data on energy consumption, emissions, water usage, and waste management.

- Social impacts: Details on social initiatives and their impact on stakeholders.

- Leadership Indicators:

- Life Cycle Assessment (LCA): Information on LCA practices to evaluate environmental impacts.

- Conflict management: Strategies and processes for managing conflicts within the company and with external stakeholders.

- Biodiversity: Efforts to preserve and enhance biodiversity.

- Scope 3 Emissions and Supply Chain: Data on scope 3 emissions and sustainability practices within the supply chain.

Regulatory and Voluntary reporting

BRSR encompasses both regulatory and voluntary reporting requirements, allowing companies to demonstrate their commitment to sustainability beyond compliance. It aligns with global standards and frameworks, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD).

Taking a step forward, SEBI introduced mandatory “Reasonable Assurance” of 9 Core ESG attributes (consisting of set of Key performance indicators (KPIs) by an independent third-party Assurance provider. This shall be applicable for top 1000 listed companies (as per market capitalization) in a gradual pathway as follows:

|

Financial year |

Gradual pathway for adopting mandatory “Reasonable Assurance” for BRSR Core |

|

FY23-24 |

Top 150 Companies |

|

FY24-25 |

Top 250 Companies |

|

FY25-26 |

Top 500 Companies |

|

FY26-27 |

Top 1000 Companies |

How DNV can help

Today, external assurance is increasingly recognized as essential for credible sustainability reporting and for driving performance improvements. Both internal risk management functions and external assurance providers are sought by a growing number of global organizations.

DNV adheres to key guiding principles in the assurance process to ensure accuracy, completeness, comparability, consistency, cost-effectiveness, reliability, validity, and, importantly, transparency. Here’s how we ensure top-notch assurance for your BRSR needs:

DNV’s assurance methodology ensures following:

- Rigorous process analysis: Our verification goes beyond data correctness. We analyse strategies, policies and processes to ensure alignment with reporting criteria.

- Multidisciplinary expertise: Our extensive industry expertise helps organizations continually enhance their sustainability performance and reporting practices based on comprehensive feedback from DNV experts.

- Risk-Based Approach: We focus assurance efforts on areas of greatest risk, enhancing the relevance and effectiveness of our services.

- Structured Assurance: We offer a well-organized approach for validating forward-looking information, ensuring that assurance activities are conducted at a "reasonable" level.

- Regulatory Alignment: Our services help you meet ESG regulatory requirements, ensuring compliance and transparency.

- Enhanced Stakeholder Confidence: DNV’s global reputation ensures your stakeholders can trust your sustainability practices and disclosures.

- Local and Global expertise: With offices around the world, we provide both international and region-specific insights to address unique challenges.

- Integrity and Competence: The credibility of our assurance relies on the integrity, independence, and competence of our verifiers. We maintain stringent requirements and offer extensive training to ensure our team’s qualifications.

Independence and Impartiality:

DNV places a strong emphasis on independence and impartiality in conducting assurance engagements. Our team members adhere to the DNV Code of Conduct and compliance program, ensuring unbiased and objective assessments.

Competency:

Our assurance teams possess deep expertise in sustainability reporting and assurance practices. They are equipped with

- Advanced assurance skills: Developed through extensive training and practical experience.

- Ethical understanding: Familiarity with relevant ethical standards and independence requirements.

- Subject matter expertise: Competence in specific sustainability topics and measurement criteria.

Reasonable assurance and competency:

Achieving reasonable assurance often requires additional competencies to address complex challenges. Our specialized teams bring thematic and industry expertise, enhancing the depth and value of our assessments.

For more information on how DNV can support your ESG and BRSR needs, contact us.

DNV recognized in leaders’ quadrant for ESG & Sustainability Assurance Services.